iowa capital gains tax on property

If line 6 of the IA 1040 includes a capital gain transaction you may have a qualifying Iowa capital gain deduction. In this article were going to look at taxes on selling rental property in Iowa how tax sales work how to avoid paying capital gains capital gains tax on sale of rental property capital gains.

Capital Gains Tax When Selling A Home In Massachusetts Pavel Buys Houses

Sale of an asset that was acquired before October 1 1967 the date the Michigan Income Tax Act went into effect.

. Use our calculator or steps to calculate your CGT. The completed form must be included with the IA 1040 to support the Iowa capital gain deduction. New Hampshire doesnt tax income but does tax dividends and interest.

How are capital gains taxed in Iowa. The usual high-income tax suspects California New York Oregon Minnesota New Jersey and Vermont have high taxes on capital gains too. In subsequent tax years eliminate the top rate annually until a 39 flat tax rate is achieved in tax year 2026.

A good capital gains calculator like ours takes both federal and state taxation into account. The Iowa capital gain deduction allows taxpayers to exclude from income net capital gains realized from the sale of all or substantially all of the tangible personal property or service of a business which has been held for at least ten years meeting the criteria of one of the six categories listed below. The current statutes rules and regulations are legally controlling.

In addition a capital gain that qualifies for the deduction. Certain sales of businesses or business real estate are excluded from Iowa taxation but only if they meet two stiff tests. Property and capital gains tax.

Before you complete the applicable Iowa Capital Gain Deduction IA 100 form review the Iowa Capital Gain. Iowa Form 100B - Iowa Capital Gain Deduction Real Property Used in a Non-Farm Business. When a landowner dies the basis is automatically reset to the current fair market value at the time of death.

Iowa Form 100E - Iowa Capital Gain Deduction - Business. The MI-1040D is filed only when there is a difference between your federal capital gainslosses and Michigan capital gainslosses. Most property except your main residence home is subject to capital gains tax.

Laws passed in 2018 and 2019 would have restricted the availability of the Iowa capital gain deduction beginning in 2023 to sales by those who met these conditions. If your taxable income is less than 80000 some or all of your net gain may even be taxed at zero percent. Beginning in tax year 2023 implement four tax brackets ranging from 44 to 60.

Calculate the capital gains tax on a sale of real estate property equipment stock mutual fund or bonds. The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. Iowa has a unique state tax break for a limited set of capital gains.

In fact the same income tax rates apply to all Iowa taxable income whether stemming from ordinary income or a capital gain. Should the Department request it the information on the Capital Gain Deduction Checklist will be needed to verify whether you qualify for the deduction. Under this provision the.

That applies to both long- and short-term capital gains. The law modifies the capital gain deduction allowed for the sale of real property used in a farming business beginning in tax year 2023. Iowa has a relatively high capital gains tax rate of 853 but the amount an individual actually needs to pay will generally be lower as the state allows a deduction for federal income tax.

In a nod to the states agricultural industry Iowa also has cutouts to its capital gains tax where family-owned business that have operated for a significant amount of time are. The tax provisions allow landowners to sell property but defer the tax under Section 1031. Iowa tax law generally follows the federal guidelines on the exclusion of gain on the sale of a principal residence.

Notice these rates are much lower than normal federal income tax brackets. The gain attributable to the period. Iowa Capital Gains Deduction.

A difference will only occur for one of the following reasons. Iowa however does. The Iowa capital gain deduction is subject to review by the Iowa Department of Revenue and must be reported on an Iowa Capital Gain Deduction IA 100 form.

This includes rental properties holiday houses hobby farms vacant land and business premises. A 39 flat tax is projected to save Iowa taxpayers more than 167 billion by tax year 2026. To claim a deduction for capital gains from the qualifying sale of employer securities to a qualified Iowa employee stock ownership plan ESOP complete the IA 100F.

Capital gains that qualify for the deduction result from the sale of real estate that is used in a trade or business in which the taxpayer materially participated for 10 years immediately before the sale and which has been held for at least 10 years immediately bore the sale. First the administration wanted to impose the capital gains tax only when the heir sold the property. Capital Gains Taxes on Property.

Includes short and long-term Federal and State Capital Gains Tax Rates for 2021 or 2022. A Like-Kind Exchange with a conservation agency might help you protect land while deferring capital gains taxes. Second Vilsack said the Biden plan would exempt all capital gains of up to 25 million.

This provision is found in Iowa Code 422721. There is currently a bill that if passed would increase the. Keeping records for property.

The capital gains tax on most net gains is no more than 15 percent for most people. The taxes for selling rental property in Iowa can be incredibly confusing for plenty of reasons but dont worry Im here to help you out. Consequently Iowa would tax the capital gain from a typical stock sale at a rate of 898 percent the rate that applies to an individuals taxable income exceeding 69255 for tax year 2015.

Hawaiis capital gains tax rate is 725. The long-term capital gains rate is 15 for single filers with taxable incomes between 40401 and 445850 and for couples filing jointly with incomes between 80801 and 501600. A copy of your federal Schedule D and federal form 8949 if applicable must be included with this return if required for federal purposes.

3 Above those incomes the rate is 20. Iowa does not tax capital gains resulting from the sale of property used in trade or business for at least 10 years. So in Feenstras example the son or daughter wouldnt have to pay taxes when they inherited the farm only when they sold it.

Enter 100 of any capital gain or loss as reported on federal form 1040 line 7. As of 2021 the long-term capital gains tax is typically either zero 15 or 20 percent depending upon your tax bracket. The Department will use this form to verify that the taxpayer qualifies for the deduction.

You must complete the applicable IA 100 form to make a claim to the Iowa capital gain deduction on your return. Recent Tax Reduction and Action However 2018 legislation slightly reduced the states personal income and individual capital gains tax rate from 898 percent to 853 percent in 2019. Your main residence home.

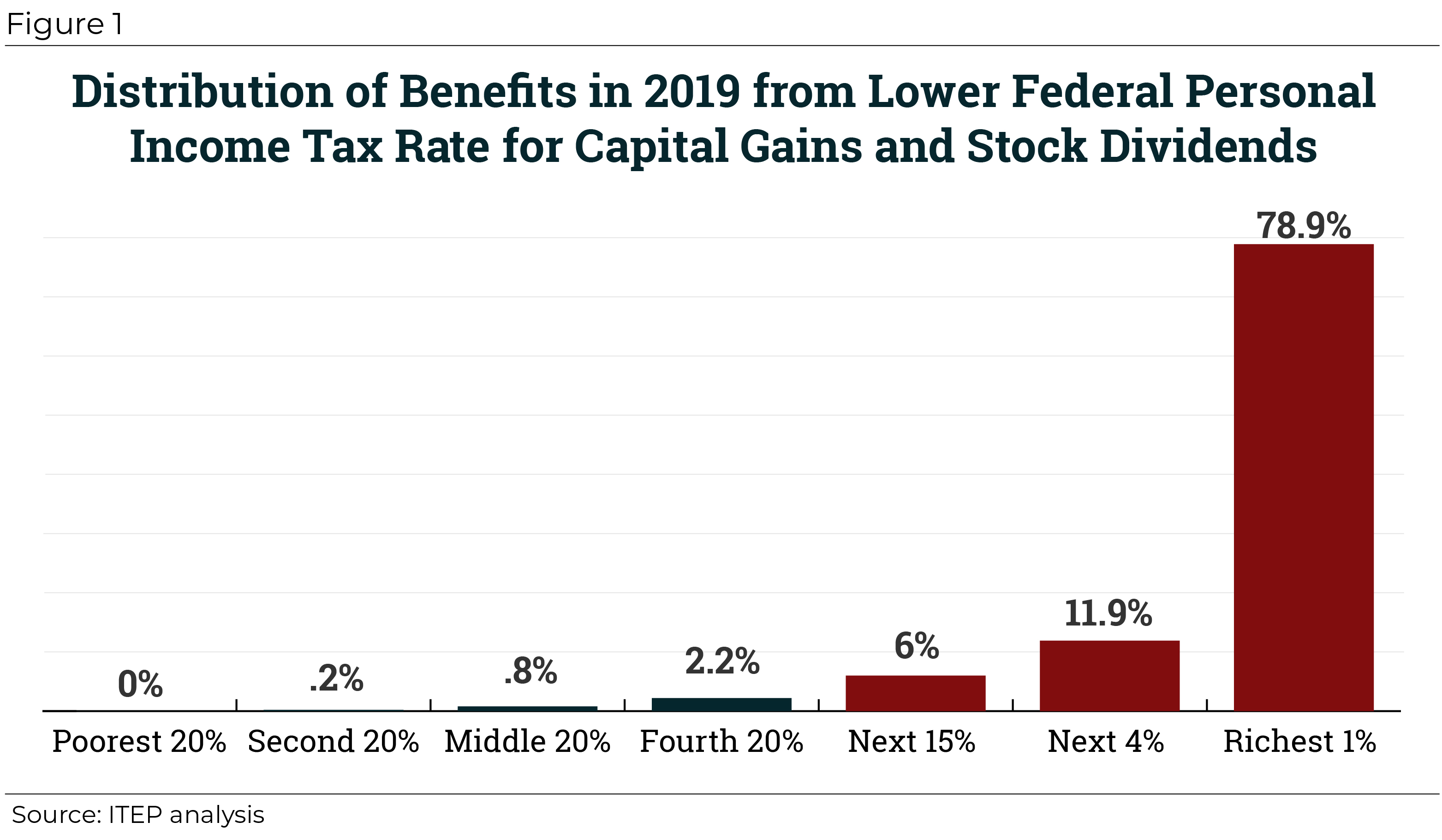

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Capital Gains Tax On Property Development Projects Developer Explains

Tds Statement U S 194 Ia Now Rectifiable Taxworry Com Statement Capital Gains Tax Transfer Pricing

How To Pay 0 Capital Gains Taxes With A Six Figure Income

The Preferential Tax Treatment Of Capital Gains Income Should Be Curbed Not Substantially Expanded Itep

The States With The Highest Capital Gains Tax Rates The Motley Fool

Notice From Cpc Tds To Persons Who Registered Home In Fy 2013 14 Who Should Not Bother Too Much Taxworry Com Cpc Bothered Capital Gains Tax

Cornering The Market Rental Income Advisors Rental Income Capital Gains Tax Rental

What Are Cgt Implications For Returning Uk Expats International Adviser

Amendment To Sec 40 A Ia By Finance Act 2012 Retrospective Itat Http Taxworry Com Amendment Sec 40aia Finance Act 2012 Retrospe Finance Acting Investing

How High Are Capital Gains Taxes In Your State Tax Foundation

Long Term Capital Gain Tax Rate For 2018 19 Capital Gain Capital Gains Tax What Is Capital

How To Calculate Capital Gain Tax On Sale Of Land Abc Of Money

Do You Have To Pay Capital Gains Tax On Property Sold Out Of State

Capital Gains Tax Iowa Landowner Options

Survey U S 133a 9 Actions Tax Law Does Not Permit Http Taxworry Com Survey Us 133a 9 Actions Tax Law Permit Surveys Tax Capital Gains Tax

Real Estate Capital Gains Calculator Internal Revenue Code Simplified

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021